child tax credit 2021 october

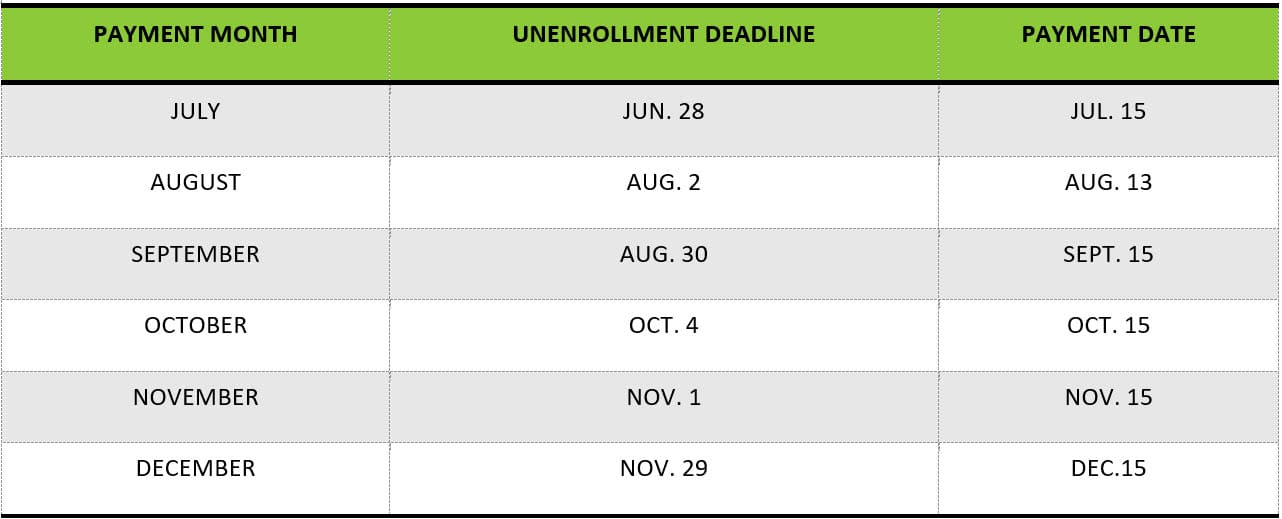

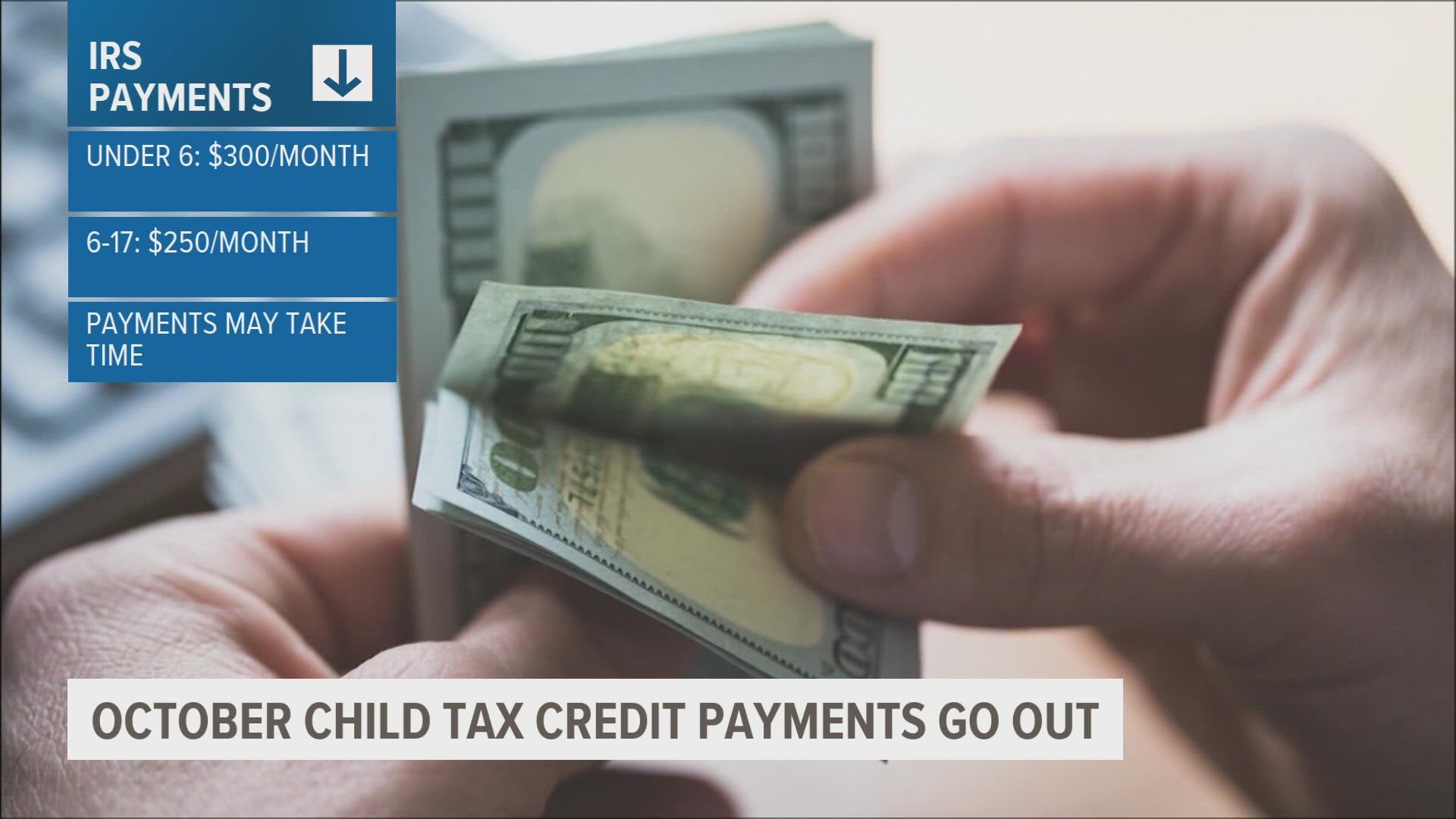

For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks through the mail anywhere from a few. Reverts back to up to 2000 for 2022 2025.

Child Tax Credit Advanced Payments Information Bc T

October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion.

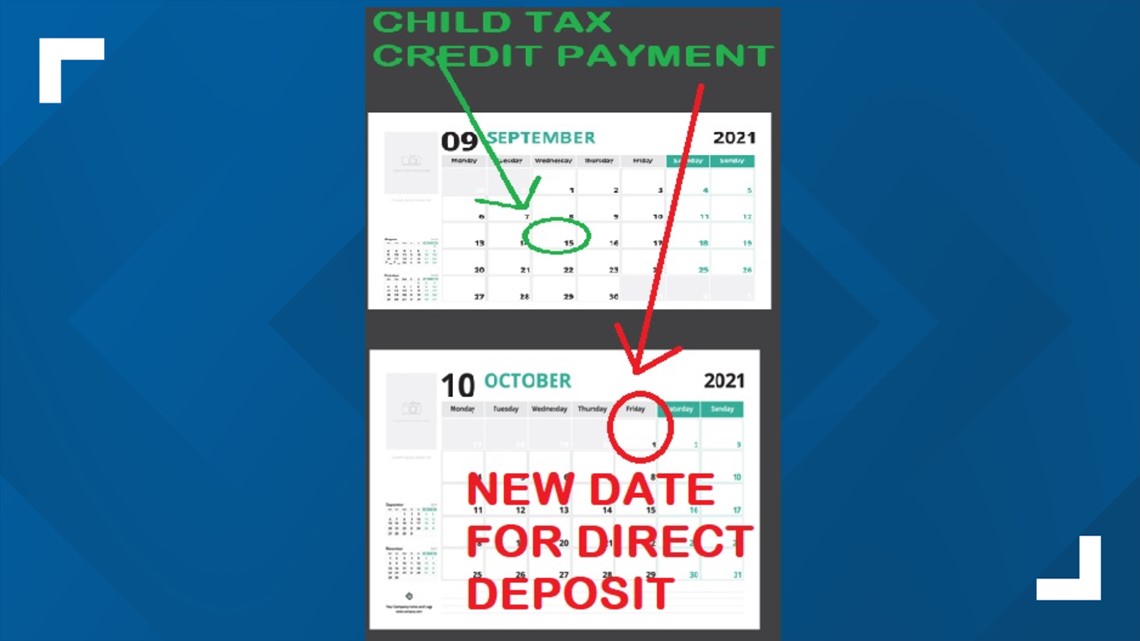

. October 8 2022 Ritika Khara Stimulus Check US Local News 0. 152 PM EDT October 15 2021. The IRS will soon allow claimants to adjust their.

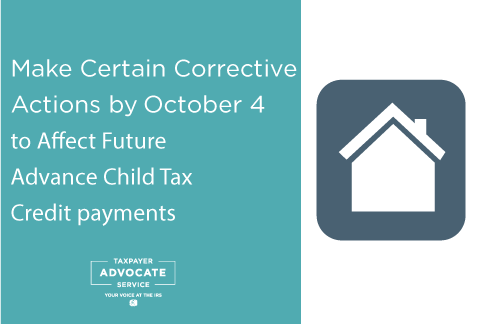

October 5 2022 Havent received your payment. Changes in income filing status the birth or. IR-2021-201 October 15 2021.

1252 PM CDT October 15 2021. That means another payment is coming in about a week on Oct. 920 AM MDT October 17 2021.

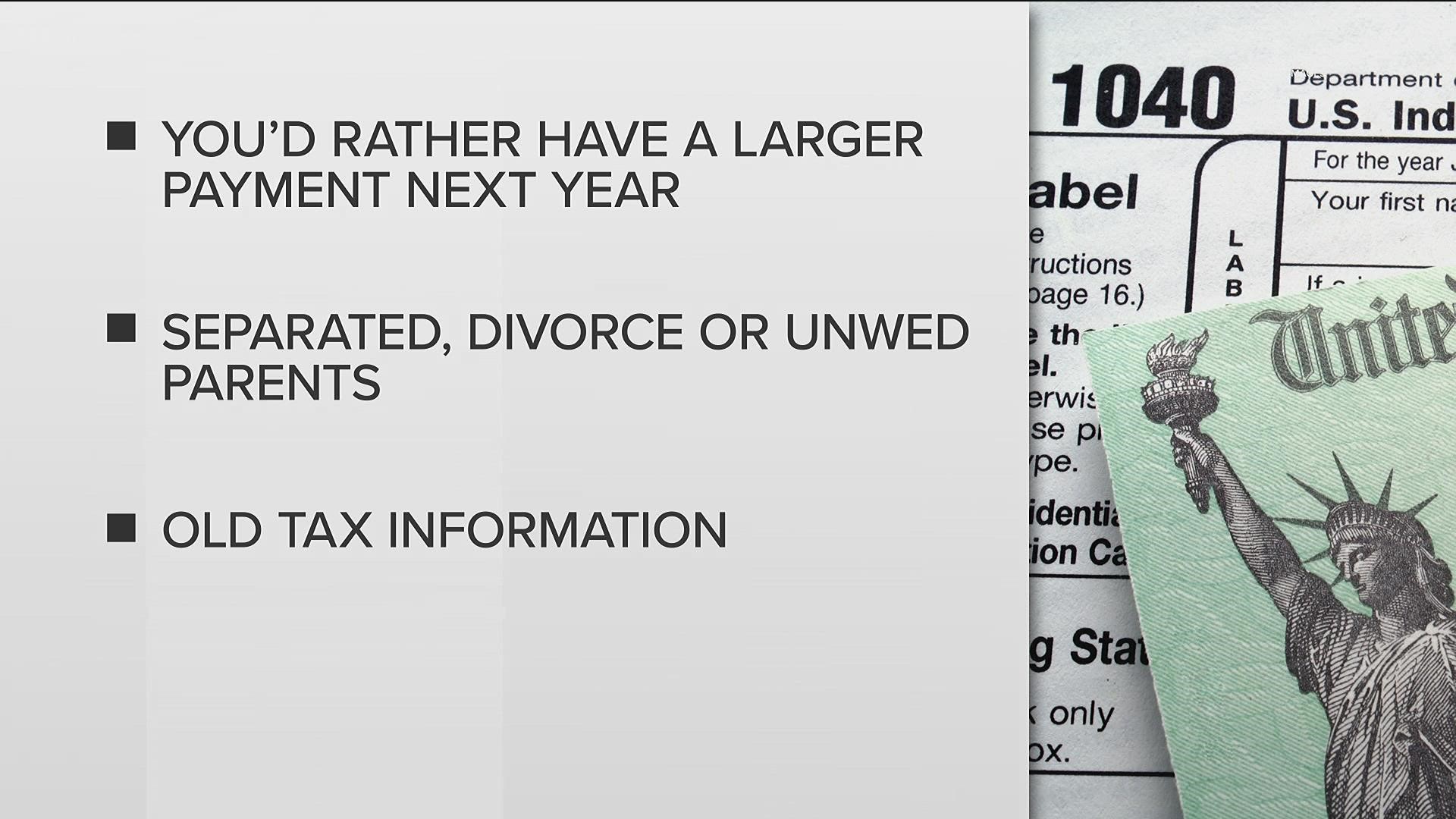

The American Rescue Plan Act ARP enhanced the CTC for 2021 considerably creating the largest US. The monthly 2021 Child Tax Credit payments were based on what the IRS knew about you and your family from your 2019 or 2020 tax return. As part of the.

Most families with children who qualify for. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages. Ontario trillium benefit OTB Includes Ontario energy and property.

The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and. For families with qualifying children who did not turn 18 before the start of this year the 2021 Child Tax Credit. Last year the increased Child Tax Credit was a birth parents.

The payment is 250 for a child from 6 years old to 17 years old or 300 for a child under 6 years. Most families are eligible to receive the credit for their children. Childhood poverty levels which decreased due to the legislation now are expected to.

The Child Tax Credit reached 611 million children in. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. The credit enabled most working families to claim 3000 per child under 18 years of age and 3600 per child six and younger.

Child Tax Credit rates for the 2022 to 2023 tax year. That depends on your household income and family size. For each child this is known as the.

5 hours agoOnline registration is still open till Nov. The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and. Every year the IRS updates CTC which stands for Child Tax Credit to update the requirements and tax credits.

Wait 10 working days from the payment date to contact us. The ARPA increased the CTC from 2000 to 3000 per child for children between 6 years and 17 years and 2000 to 3600 for children below 6 years. The basic amount this is known as the family element Up to 545.

The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021. The credit enabled most working families to. 7 hours agoThe last monthly payment of the federal Child Tax Credit expansion was distributed 2021.

For tax year 2022 the Child Tax Credit reverts back to the benefits available prior to the American Rescue Plan as follows. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and.

That program part of the 2021 American Rescue Plan Act let families receive up to 3600 per child under the age of 6 and 3000 for children ages 6 to 17. Child tax credit ever. All eligible families could receive the full credit if.

When Is The Child Tax Credit October Opt Out Deadline King5 Com

Tag Archive Child Tax Credit American Enterprise Institute Aei

Members 1st Federal Credit Union Eligible Families Have Begun Receiving Monthly Child Tax Credit Payments And They Will Continue To Be Issued Through December 2021 View The Irs Payment Schedule

October Child Tax Credit Payment U S Gov Connect

Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa

Fact Sheet Advance Child Tax Credit

Child Tax Credits When Is The October Payment And What Is The Deadline To Unenroll From Monthly Payments

How Much Money Has The Child Tax Credit Given Families In 2021 As Usa

Irs Delays Some September Child Tax Credit Payments Until Oct Wfmynews2 Com

Child Tax Credit 2021 8 Things You Need To Know District Capital

Eligible Families Can Expect Child Tax Credit Payments For October

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat Center On Budget And Policy Priorities

Child Tax Credit Helps Working Families Cut Child Poverty Monticello Central School District

E C Financial Services And Tax Preparation Child Tax Credit Expansion When Will The First Checks Get Sent Out We Know The Child Tax Credit Payments Will Begin Arriving In July But

Child Tax Credit Schedule How Many More Payments Are To Come Marca

Tax Tip Use The Child Tax Credit Update Portal To Make Changes For Future Payments

Advance Child Tax Credit Update October 12 2021 Youtube

Child Tax Credit 2021 When Will October Payments Show Up Weareiowa Com

Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month Wgn Tv